These reports are prepared in this order and are issued to the public as a full set of statements. This means they are not only published together, but they are also designed and intended to be read and used together. Since each statement only gives information about specific aspects of a company’s financial position, it is important that these reports are used together. Whether you’re a do-it-yourself investor or rely on guidance from an investment professional, learning certain fundamental financial statement analysis skills can be very useful. Almost 30 years ago, businessman Robert Follett wrote a book entitled How To Keep Score In Business.

Create sub-accounts

The cash flow statement reconciles the income statement with the balance sheet in three major business activities. The cash flow statement complements the balance sheet and income statement. Use your net profit (or net loss) from your income statement to prepare your statement of retained earnings. After you gather information about your net profit or loss, you can see your total retained earnings and how much you’ll pay out to investors (if applicable).

Additional Resources

The statement then deducts the cost of goods sold (COGS) to find gross profit. Investors and creditors analyze this set of statements to base their financial decisions on. They also look at extra financial reports like financial statement notes and the management discussion. This statement simply lists the balances of your accounts, which you would have calculated before preparing your trial balance. The net income calculated at the end of the income statement is added to retained earnings, which is required to complete the statement of changes in equity. Preparing financial statements is a crucial skill to learn for any founder.

Balance sheet example

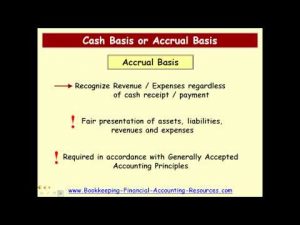

After gathering financial data, accountants must adjust and classify transactions according to the appropriate accounting principles and standards. Net income is either retained by the firm for growth or paid out as dividends to the firm’s owners and investors, depending on the company’s dividend policy. Preparing general-purpose financial statements can be simple or complex depending on the size of the company.

The statement divides the cash flows into operating cash flows, investment cash flows, and financing cash flows. The final result is the net change in cash flows for a particular time period and gives the owner a very comprehensive picture of the cash position of the firm. Your profit and loss statement, also called an income statement, summarizes your business’s financial performance over a period of time — daily, weekly, monthly, quarterly or annually. It is an important document because it tells you the company’s biggest areas of expenditures and revenues.

The completed financial statements are then distributed to management, lenders, creditors, and investors, who use them to evaluate the performance, liquidity, and cash flows of a business. The preparation of financial statements includes the following steps (the exact order may vary by company). The statement of cash flows must be prepared last because it takes information from all three previously prepared financial statements.

This statement shows the distribution of profits that are retained by the company and which are distributed as dividends. QuickBooks gives you flexibility as to how the statements are used and shared. You can view them in QuickBooks, email them to yourself or another member of the business or export them for later viewing. QuickBooks even lets you schedule financial reporting, so you can automatically receive and share updated financial statements on a periodic basis. The statement of owner’s equity is a summary of the business owner’s investment in the business.

- The same thing could be said today about a large portion of the investing public, especially when it comes to identifying investment values in financial statements.

- If you identify an error or discrepancy in your financial statements, take the time to revise your accounting procedures.

- Financial reporting refers to communicating an organization’s financial information and performance to various stakeholders, including investors, creditors, regulators, and the general public.

- The equity figure calculated when preparing the statement of changes in equity goes in this section.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

In essence, these reports complete the fundamental purpose of financial accounting by providing information that is helpful in the financial decision-making process. Cash flow from investing activities includes cash received from the sale of securities and cash paid to buy new assets like land and equipment, among other things. The process of preparing a cash flow statement depends power system analysis on whether you’re using the direct or indirect method. Balances of current liabilities like accounts payable and long-term liabilities like bonds appear here. While there is a difference in the accounting standards between GAAP and IFRS, the purpose of each financial statement remains the same. Print a preliminary version of the financial statements and review them for errors.

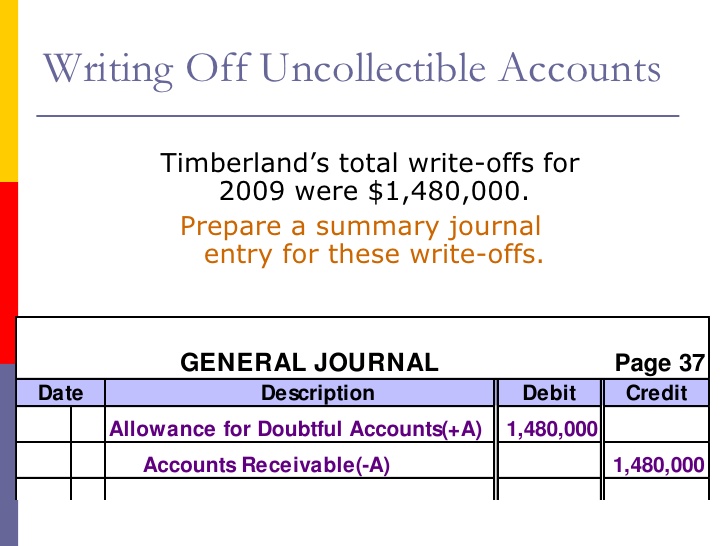

Balance sheet accounts calculate working capital and other important ratios. Most investors and creditors use financial ratios to analyze these comparisons. There is almost no limit to the amount of ratios that can be combined for analysis purposes. There are additional line items in this section as well if you’re using the indirect method. All debits have corresponding credits – of equal amounts – according to double-entry accounting. For this reason, a trial balance is built to check if the debits and credits are equal; if the total debit and credit amounts are different, you’ll need to check for arithmetic errors.

Use the information from your income statement and retained earnings statement to help create your balance sheet. Now that you know all about the four basic financial statements, read on to learn what financial statement is prepared first. If they don’t, your balance sheet is unbalanced, and you need to find what’s causing the discrepancy between your assets, liabilities, and equity. Current assets are items of value that can convert into cash within one year (e.g., checking account). Noncurrent assets are items of value that take more than one year to convert into cash.

Then, list out any expenses your company had during the period and subtract the expenses from your revenue. The bottom of your income statement will https://www.business-accounting.net/partial-income-statements-of-company-a-and-company-b-are-provided/ tell you whether you have a net income or loss for the period. Your income statement gives you insight into your company’s income and expenses.

The next step is to post journal entries to sub-ledger accounts, which are accounts that record details and provide more context than the overarching general ledger. Sales transactions are posted to the sales ledger, credit sales are recorded in the accounts receivable ledger, and so on – you get the idea. Ideally, the income tax rate should be based on your estimate of the average tax rate that will apply for the entire fiscal year. Conduct a bank reconciliation, and create journal entries to record all adjustments required to match the accounting records to the bank statement. This is an essential activity, since there are always reconciling items on the bank statement. Compare the shipping log to accounts receivable to ensure that all customer invoices have been issued.

It shows revenue from primary income sources, such as sales of the company’s products, and secondary sources, like if the company sublets a portion of its business premises. Financial reporting refers to communicating an organization’s financial information and performance to various stakeholders, including investors, creditors, regulators, and the general public. It involves the preparation and presentation of financial statements, along with supplementary disclosures, https://www.simple-accounting.org/ in a standardized format that follows applicable accounting principles and regulatory requirements. This income figure comes in handy as an overall summary regarding the profitability of your business, and you’ll need it to calculate your retained earnings after accounting for dividends that you pay out. An analyst may first look at a number of ratios on a company’s income statement to determine how efficiently it generates profits and shareholder value.