QuickBooks Online offers a large selection of reports, but they aren’t industry-specific. QuickBooks offers six accounting products, but one of its online accounting plans will be the best choice for most small businesses. Freelancers and independent contractors may opt for simpler options, while larger small businesses might turn to QuickBooks products with advanced inventory, sales and reporting features. Larger businesses with substantial accounting teams may want to consider the QuickBooks Advanced plan. It covers up to 25 users and provides dedicated customer support and advanced reporting features. For instance, while QuickBooks offers some of the most fully featured accounting programs, most of its products cost more than comparable accounting solutions for small businesses.

Cost of QuickBooks Online vs. QuickBooks Self-Employed

Christine Aebischer is an assistant assigning editor on the small-business team at NerdWallet who has covered business and personal finance for nearly a decade. Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business https://www.business-accounting.net/replacement-value/ lending, software and insurance. She has also held editing roles at LearnVest, a personal finance startup, and its parent company, Northwestern Mutual. The entry-level QuickBooks versions, like Simple Start ($12) and QuickBooks Self-Employed ($7), only support one user.

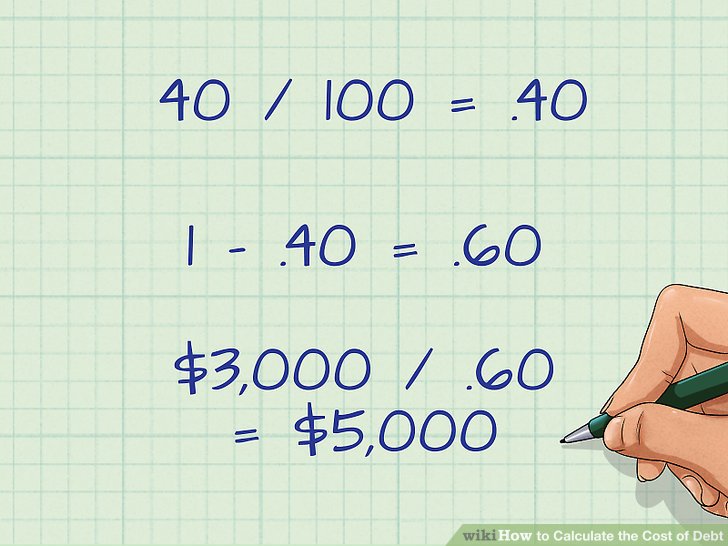

Quarterly Estimated Tax Calculation

And while the QuickBooks Desktop mobile app is fine, that’s really all it is—fine. For general contractors who travel between job sites and need fast, on-the-go account access, a QuickBooks Online plan could suit better. While we love QuickBooks Online’s accessibility, low learning curve, and simple scalability for multiple business types and sizes, it’s one of the pricier cloud-based accounting solutions. QuickBooks for desktop also has a more complicated interface than QuickBooks’ online software. If you’re already familiar with business financials (including if you’re an accountant), QuickBooks Desktop plans give you heftier fiscal reports and more complex accounting features.

All plans include

This way, you find the QuickBooks-compatible tools that best tackle your specific business challenges. QuickBooks is a comprehensive accounting software suite designed by Intuit to help businesses of all sizes manage their finances efficiently and accurately. But there isn’t just one version of QuickBooks—if QuickBooks Online doesn’t work for you, another one of the six different versions of QuickBooks could. Plus, QuickBooks isn’t the only accounting solution in the world—far from it.

- This helps you identify potential problems and make adjustments once you determine that your projects are not profitable.

- Both QuickBooks Online and QuickBooks Desktop are capable programs with strong accounting features.

- Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually.

- With QuickBooks Online, users receive many of the same great features while gaining the mobility of cloud-based software.

- QuickBooks for Mac is an accounting software developed by Intuit specifically for Apple’s macOS operating system.

Start with a basic subscription tier.

Small businesses that are growing may want to use QuickBooks Essentials. The plan offers up to three users all the features of QuickBooks Simple Start, plus the ability to track hours worked and manage bills. A key added feature of the QuickBooks Essentials plan is the ability to manage unpaid bills and allocate billable time and expenses to a specific customer.

If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees. QuickBooks Desktop has a more dated user interface than some cloud-based products and requires prior accounting knowledge to get the most out of the product. Two key options are QuickBooks Online (QBO) and QuickBooks Self-Employed (QBSE).

QuickBooks Online is our overall best small business accounting software. To help narrow down the best plan for your business, answer a few short questions below. This will offer you a customized recommendation based on the responses you give. Afterward, continue reading our article for a more detailed comparison of the five QuickBooks Online plans. QuickBooks Online offers four standard plans—Simple Start, Essentials, Plus, and Advanced—with prices ranging from $30 to $200 per month.

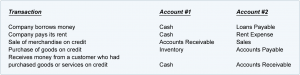

QuickBooks Online Advanced now offers a fixed asset accounting feature that allows you to enter and track fixed assets, such as vehicles, buildings, and equipment. Based on the depreciation method you choose, Advanced automatically calculates the depreciation for the fixed asset and creates a depreciation schedule. Simple Start runs basic reports, including cash flow statements, https://www.intuit-payroll.org/ profit and loss (P&L) statements, and balance sheets. Some of the other 20-plus built-in standard reports available include P&L by month and customer, quarterly P&L summaries, and general ledger. If you want a dedicated expert to handle your ongoing bookkeeping work, you can sign up for QuickBooks Live Bookkeeping, available in Simple Start and higher plans.

Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform. The software must have enough reports that can be generated with a few clicks.

Not all versions of QuickBooks offer multiple plans or make it simple to move your business from one product to another. If you think you’ll need more advanced features in the future, it’s important to make sure you choose an option that can accommodate those needs. This is a desktop product, meaning you download and install it on your computer.

Small business owners that previously used spreadsheets save an average of 25 hours per month on manual entry with QuickBooks3. With QuickBooks, small business owners have more time to spend running their business and managing all aspects of their business from invoicing, managing inventory, and paying bills right from QuickBooks. Many of the household accounting software names, such as QuickBooks, Xero and Zoho Books, can be classified as integrated accounting software solutions.

Plus allows you to assign classes and locations to your transactions, so you can see how your business performs across divisions, locations, rep areas, or any units that are relevant to your business. If you run businesses in multiple locations and you want to see which one is most profitable, an upgrade to Plus from Essentials is worth the price. The QuickBooks Online comparison chart below highlights some of the key features of the five versions. We include in-depth, side-by-side comparisons of each plan against its next-level tier in the sections that follow.

In comparison with QuickBooks Desktop, QuickBooks Online is cloud-based, cheaper, easier to use, supports more integrations, and is unlikely to be discontinued by QuickBooks. If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live bookkeeper’s work. You can send a copy of your company file to your accountant and import their changes. However, Intuit announced that support for QuickBooks Desktop Pro will cease after May 31st, 2023. It’s very likely that Intuit QuickBooks Enterprise and QuickBooks Premier will follow suit in the years to come.

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users the difference between fasb and gasb effects on the statement of cash flows to pay sales tax liability. Advanced also removes the limitations on the number of classes, locations, and charts of accounts, making it ideal for businesses with a growing staff. It also has a batch invoicing and expense management feature, which is ideal for those who manage a large volume of invoices and expenses daily.

If not, QuickBooks Online is much more user-friendly, even for accounting newbies. Launched in 2004, QuickBooks Online is cloud-based accounting software used by over two million people. With strong accounting capabilities, impressive features, 650+ integrations, and fully-featured mobile apps, it’s no wonder this is one of our top accounting recommendations.